11 New Forex and Crypto Scams

On September 7th, 2020, the Italian Companies and Exchange Commission (CONSOB) announced that they had ordered the “black-out of 11 new websites”, on account of these sites offering fraudulent financial services. The “black-out” language is the reputable Italian regulator’s way of saying we’ve placed these companies on the CONSOB Blacklist. We’ll be explaining who these companies are in this article.

The scam companies range from Forex brokers to Crypto trading platforms. One thing they all have in common is that they take money from unsuspecting individuals with no intention of ever returning any return on their investment or any amount of money whatsoever.

The websites that were ordered to be placed on the blacklist were;

- marketsdock.com Owned by Dinengo Partners Ltd.

- jp.finance owned by Jean Pierre Technologies Ltd.

- topcapitalfx.com owned by KBS Capital Markets Ltd.

- northfintechfx.co and northfintechfx.trade owned by NorthfintechFX Trading Services Ltd.,

- wallwoodbroker.com listed as Wallwood Broker

- 247firstinvest.com 247 First Invest

- uptos.org owned by Uptos Ltd.

- marketfxc.com owned by Equalizer Ltd.

- cfgtrades.com owned by InterMedia Ltd.,

- acquantum.eu owned by Acquantum Ag,

- matrixbanco.com Matrix Bench

Pending Criminal Investigation

These 11 websites, although they haven’t yet been prosecuted in a court of law, are in violation of “Article 18 of Legislative Decree no. 58 of 24 February 1998, pursuant to article 7-octies, letter b) of the same legislative decree”. CONSOB has been very diligent and clear that these companies and their websites are operating without any authorization. It’s our hope and the hope of the many victims that CONSOB acts decisively in pursuing the individuals responsible for the fraud committed.

Forex Fraud and Crypto Scams the same as before

To those familiar with online trading scams and in particular Forex scams and Crypto scams, these 11 companies and their operations are textbook examples of Forex fraud and fake Crypto platforms. There was absolutely nothing innovative found on any of the websites involved and it is safe to say that the perpetrators of these scams are not new to their craft.

It should be noted that as of the writing of this post, these trading scam websites are still operating and targeting victims.

279 Websites banned

With these 11 companies added to the CONSOB blacklist, the total number of websites that the Italian regulator has banned has increased to a whopping 279 since July, 2019.

Many of the websites on the CONSOB blacklist are clones of established brands such as KBS Capital Markets Ltd. whose legitimate counterpart is KBS Capital Markets Group.

While scams of this kind can at times be easy to discern by the integrity of the information on the website, scam websites have become very professional in appearance and functionality. Because website builders have become easily accessible, as well as forwarding numbers and even virtual addresses, internet scams are constantly becoming a greater threat to consumers.

This is especially true in the financial services industry which, by using what appear to be attractive opportunities and professional services, scammers are able to take advantage of victims and convince them to invest large amounts of money. Unfortunately this often means individuals losing their hard earned money without any recourse. In some cases individuals and families have lost their life savings. Given the uncertain nature of real estate or other financial investments, it’s very easy for victims to be tricked into believing that they are simply betting on a low-risk, high-return project that not a lot of people know about.

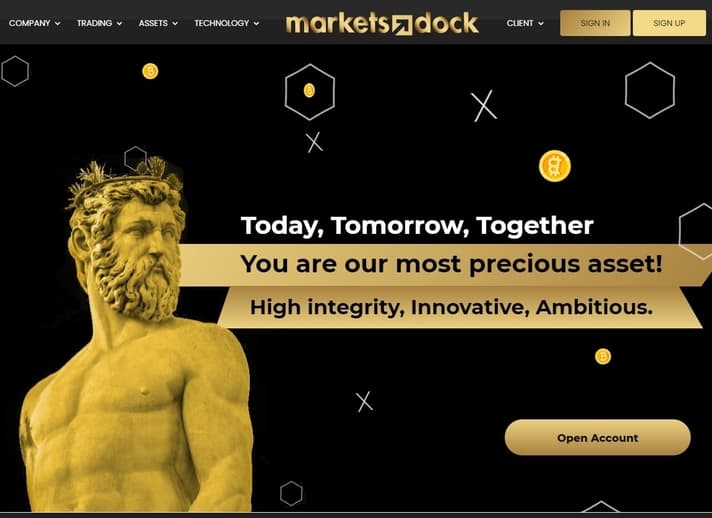

Below is the Markets Dock scam homepage. As one may tell from the menu and overall design, the average layperson could easily assume that this is a legitimate investment company.

Avoiding Trading Scams

The easiest way to avoid this type of scams is to diligently research the company before making any investments. In the financial world, if something looks too good to be true, it is most likely fraudulent. In order to avoid this, you must cross-reference websites that look similar to the illegal website in question. However, we must mention that checking for these scams are nearly impossible as even if you contact the phone number on the website, there is no way to check whether or not you’ve been connected to the legitimate customer support center or another scammer waiting for their next victim.

For these reasons and to guarantee your safety from these types of scammers it is often recommended to stick with financial institutions that you’re familiar with or that you’ve done business with in the past. You can also check out our article on how to identify a Forex scam here.

In the case of clones, it can be easier to identify counterfeits of businesses that you are more familiar with. If you’ve done business with a company, you may know when something sounds fishy. Moreover, the brands of financial service institutes with longevity tend to be harder to clone without a heavy backlash. Large companies will inform clients and post warnings if such an incident were to occur.

Does anyone know if Tradingsky.xyz is a scam site?

CryptoniumX is a scam and uses a trader brandon_bit fxtrade and telegram @trustcrypto AKA Crypto Signals

Better Watch out for Bitles.

Not Trust Worthy – Changed Stated commitments without Notice or Option to exit

Started off in about a month just fine until end of December. Got a Message out of the blue that Bitles staff taking a winter vacation and Stopped All rewards/withdrawals on platform until 2nd week of January. Well its the 1/17/21 and NO WITHDRAWALS, no help desk responses, and no e-mail responses. DEFINITELY NOT Above Board with its Customers/Users and Not a viable company if keep changing its stated commitments. Current Recommendation is STAY AWAY (if you want use of your funds as very questionable if I’ll see mine again)!!!!

Add bi-investment (.tech) to the list. Do not send your money there.

Thank you for reporting.