When Colleen, a Knoxville, Tennessee resident, noticed a duplicate charge on her credit card for an Amazon purchase, she set out to resolve the issue. However, her attempt to contact customer service turned into a nightmare that cost her her life savings.

What we cover here

An Innocent Mistake with Serious Consequences

Instead of visiting Amazon’s official website to find the correct customer service contact, Colleen conducted a general internet search for a phone number. Unfortunately, this simple action connected her not with Amazon, but with a scammer posing as an Amazon representative.

Believing she was speaking to a legitimate agent, Colleen was told her account had been compromised. She was then transferred to a man claiming to be “Agent John Davis” from the Federal Trade Commission (FTC). To gain her trust, the scammer sent her fake credentials and an official-looking FTC letter stating that her Social Security number was linked to fraud, putting her bank account at risk. Alarmed, Colleen followed his instructions.

The Costly Scam

Colleen was directed to withdraw $19,000 in cash from her savings account. She was told to deposit $15,000 into a Bitcoin ATM at a local tobacco and vape shop using a barcode the scammer provided. The remaining $4,000 was used to purchase gift cards at two retail stores, with the card details sent to the scammer.

To further deceive her, the scammer provided a fraudulent receipt for the $19,000 and assured her the funds would be returned after an FTC investigation. He also instructed her to remain silent about the matter. Now, Colleen relies on help from members of her church as she navigates the aftermath of this financial disaster.

How to Protect Yourself from Scams

Colleen’s situation serves as a stark reminder of the importance of verifying contact information. When reaching out to a merchant or company, always use the contact details listed on their official website. Avoid relying on internet searches, as scammers often create fake contact pages to lure unsuspecting victims.

Additionally, be aware of common red flags:

– **Amazon’s policies:** Amazon will never ask for your password, credit card details, or bank account information over the phone. They also won’t ask you to purchase gift cards or use Bitcoin to resolve account issues.

– **Government agencies:** The IRS, Social Security Administration, or FTC will not request payment via gift cards, Bitcoin, or cash withdrawals. Legitimate correspondence will always come through official letters, not unsolicited phone calls, emails, or texts.

If you receive such requests, consider it a red flag and verify their legitimacy by contacting the organization directly using verified contact information.

The Growing Threat of Cryptocurrency Scams

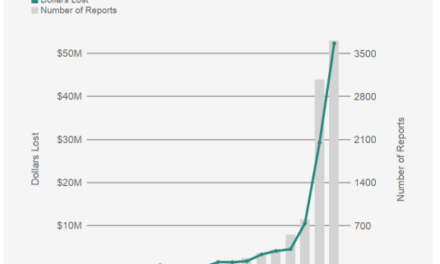

Unfortunately, scams involving cryptocurrency are becoming increasingly common. In 2023, the FBI received over 69,000 complaints related to financial fraud using cryptocurrency. The FTC also reported that consumers lost more than $10 billion to fraud in 2023 alone, a 14% increase from the previous year.

During the first quarter of 2024, government impersonation scams cost consumers $20 million in cash losses. These statistics highlight the need for vigilance when dealing with unsolicited requests for money or personal information.

Reporting Scams to Prevent Future Victims

If you encounter a scam, report it to the FTC. Sharing your experience can help prevent others from falling victim to similar schemes. Remember, staying informed and cautious can be the best defense against fraud.